|

Basic Accounting

Simplified |

Site Menu

|

|

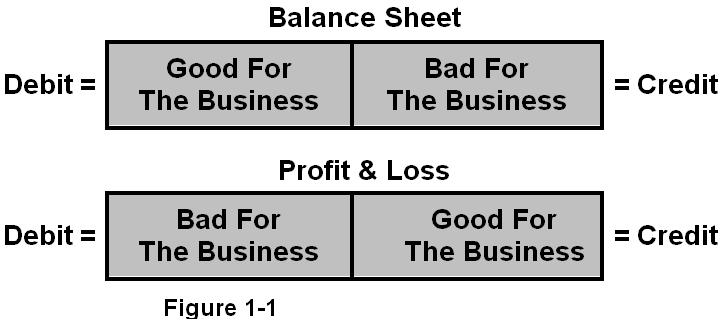

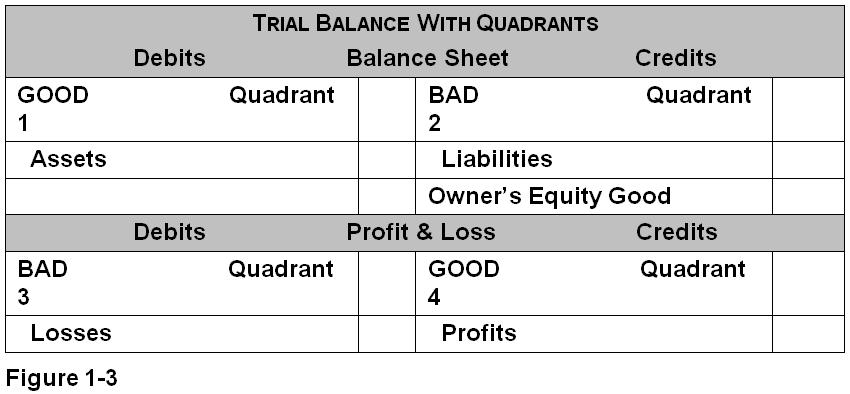

CHAPTER 1 - The Method 1. Introduction The practice or profession of accounting is more of a science than an art. The double-entry system of accounting provides assurance errors have not been made. Business transactions are recorded in journals in a well-defined manner. The recordation into the general ledger provides a pathway to the Trial Balance and ultimately to the Balance Sheet and Profit and Loss statement. This book employs a unique method of instruction in that it starts with the first phase of the accounting process, the journal entry, and skips to the last phase, the trial balance, completely omitting journals and ledgers. This will facilitate the understanding of journals and ledgers as they are later explained in Chapter 2. Slowly and gradually, a complete set of accounting books will be created. The steps involved in making a financial record of business transactions and in the preparation of statements concerning the Balance Sheet and income are fully discussed and explained. 2. Chapter Objective To learn the basics of accounting up to and including the trial balance. When the basics are understood, the more advanced aspects of accounting will be more easily understood. The following figure is an important illustration. It should be kept in mind now and throughout your accounting career (see also, Figure 1-3 located below in Section 5A). The following diagram is illustrative of one of the most basic concepts in accounting. Debits and credits can be good or bad for the business. Simply knowing whether an item is good or bad for the business and whether it is a balance sheet or profit and loss item can be used to determine whether the item is posted as a debit or credit.

The illustration shows that:

3. The Journal Entry A journal entry is the method used in accounting to record business transactions. The journal entry could be very simple by having just one debit and one credit. It could also have one debit and ten credits. It does not matter how many debits or credits a journal entry has, but the cardinal rule is the total of the debits must equal the total of the credits in every journal entry. All areas of accounting utilize journal entries. When information is recorded in any book of account it is done by journal entry, for example.

Helpful Tip. A debit is always on the left side and a credit is always on the right side. There is an “r” in credit and right.

4. The Trial Balance

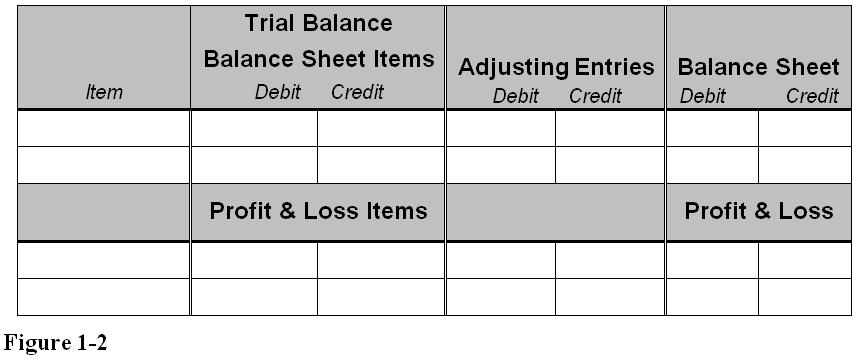

In the system of instruction (“The Method”) used in Chapter 1, all journal entries will be posted directly to the trial balance. In figure 1-2, below, in the first two columns following the “Item” column is an illustration of the Trial Balance to which all the journal entries that follow later in this chapter will be posted. The adjusting entries and the financial statements are made after the trial balance has been entered in those columns. Helpful Tip. As will be discussed later in this book, transactions are recorded using journal entries and the trial balance. At the end of each accounting period and after all the preparatory work has been done, the results are recorded in the general ledger. The net amounts contained in the general ledger are then recorded onto the trial balance. For instructional purposes, all the journal entries in Chapter 1 will be posted directly to the trial balance. Journal entry items that affect the balance sheet are placed under the caption balance sheet items, and those that affect profit and loss are placed in that designated area on the trial balance. Since they are separated in name only, a journal entry that affects both the balance sheet and profit and loss are placed in their respective areas.

5. The Balance

Sheet

Balance sheet items are those items that maintain a record as long as the business is in existence. The balance sheet items that exist at the end of an older accounting period also exist on the first day of the next (new) accounting period.

B. Liabilities

See More Inside

|

© Copyright BasicAccountingSimplified.com, 2012. All Rights

Reserved.